What is a Catastrophic Impairment?

Catastrophic Impairment Designation

A catastrophic impairment designation places you – an auto accident victim – in the highest level of impairment category available under automobile insurance regulations. While not a benefit itself, a catastrophic impairment designation is the gateway or vehicle to access enhanced benefits, where your policy limits increase to $1 million. All other impairments fall under the non-catastrophic and minor injury category.

If you want to learn more about the companion accident benefits claim, and kickstarting the accident benefits application process, then please click the “link” to read my blog entitled “How to Get Your Accident Benefits Application Started”.

The June 1, 2016 amendments to the Ontario Regulation 34/10: Statutory Accident Benefits Schedule (SABS 34/10), issued under the Insurance Act, R.S.O. 1990, c. I.8, introduced a stricter definition of catastrophic impairment. Section 3.1 was added to the SABS 34/10, which provides a tightening of the criteria for determination of catastrophic impairment.

Further to section 3.1 (1) of the SABS 34/10, for the purposes of this Regulation, an impairment is a catastrophic impairment if an insured person sustains the impairment in an accident that occurs on or after June 1, 2016 and the impairment results in any of the following:

Paraplegia or Tetraplegia

- Paraplegia or tetraplegia that meets the following criteria:

- The insured person’s neurological recovery is such that the person’s permanent grade on the ASIA Impairment Scale, as published in Marino, R.J. et al, International Standards for Neurological Classification of Spinal Cord Injury, Journal of Spinal Cord Medicine, Volume 26, Supplement 1, Spring 2003, can be determined.

- The insured person’s permanent grade on the ASIA Impairment Scale is or will be,

- A, B or C, or

- D, and

- the insured person’s score on the Spinal Cord Independence Measure, Version III, item 12 (Mobility Indoors), as published in Catz, A., Itzkovich, M., Tesio L. et al, A multicentre international study on the Spinal Cord Independence Measure, version III: Rasch psychometric validation, Spinal Cord (2007) 45, 275-291 and applied over a distance of up to 10 metres on an even indoor surface is 0 to 5,

- the insured person requires urological surgical diversion, an implanted device, or intermittent or constant catheterization in order to manage a residual neuro-urological impairment, or

- the insured person has impaired voluntary control over anorectal function that requires a bowel routine, a surgical diversion or an implanted device.

Severe Impairment of Ambulatory Mobility or Use of of an Arm, or Amputation

- Severe impairment of ambulatory mobility or use of an arm, or amputation that meets one of the following criteria:

- Trans-tibial or higher amputation of a leg.

- Amputation of an arm or another impairment causing the total and permanent loss of use of an arm.

- Severe and permanent alteration of prior structure and function involving one or both legs as a result of which the insured person’s score on the Spinal Cord Independence Measure, Version III, item 12 (Mobility Indoors), as published in Catz, A., Itzkovich, M., Tesio L. et al, A multicentre international study on the Spinal Cord Independence Measure, version III: Rasch psychometric validation, Spinal Cord (2007) 45, 275-291 and applied over a distance of up to 10 metres on an even indoor surface is 0 to 5.

Loss of Vision of Both Eyes

- Loss of vision of both eyes that meets the following criteria:

- Even with the use of corrective lenses or medication,

- visual acuity in both eyes is 20/200 (6/60) or less as measured by the Snellen Chart or an equivalent chart, or

- the greatest diameter of the field of vision in both eyes is 20 degrees or less.

- The loss of vision is not attributable to non-organic causes.

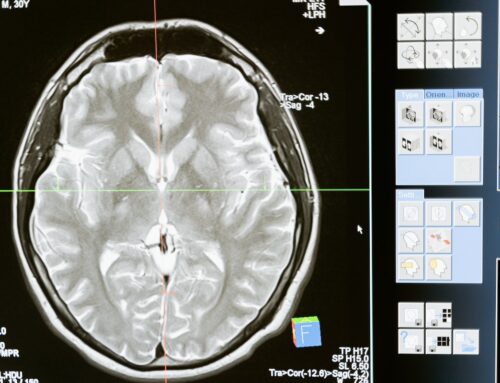

Adult Traumatic Brain Injury

- If the insured person was 18 years of age or older at the time of the accident, a traumatic brain injury that meets the following criteria:

- The injury shows positive findings on a computerized axial tomography scan, a magnetic resonance imaging or any other medically recognized brain diagnostic technology indicating intracranial pathology that is a result of the accident, including, but not limited to, intracranial contusions or haemorrhages, diffuse axonal injury, cerebral edema, midline shift or pneumocephaly.

- When assessed in accordance with Wilson, J., Pettigrew, L. and Teasdale, G., Structured Interviews for the Glasgow Outcome Scale and the Extended Glasgow Outcome Scale: Guidelines for Their Use, Journal of Neurotrauma, Volume 15, Number 8, 1998, the injury results in a rating of,

- Vegetative State (VS or VS*), one month or more after the accident,

- Upper Severe Disability (Upper SD or Upper SD*) or Lower Severe Disability (Lower SD or Lower SD*), six months or more after the accident, or

- Lower Moderate Disability (Lower MD or Lower MD*), one year or more after the accident.

Child Traumatic Brain Injury

- If the insured person was under 18 years of age at the time of the accident, a traumatic brain injury that meets one of the following criteria:

- The insured person is accepted for admission, on an in-patient basis, to a public hospital named in a Guideline with positive findings on a computerized axial tomography scan, a magnetic resonance imaging or any other medically recognized brain diagnostic technology indicating intracranial pathology that is a result of the accident, including, but not limited to, intracranial contusions or haemorrhages, diffuse axonal injury, cerebral edema, midline shift or pneumocephaly.

- The insured person is accepted for admission, on an in-patient basis, to a program of neurological rehabilitation in a paediatric rehabilitation facility that is a member of the Ontario Association of Children’s Rehabilitation Services.

- One month or more after the accident, the insured person’s level of neurological function does not exceed category 2 (Vegetative) on the King’s Outcome Scale for Childhood Head Injury as published in Crouchman, M. et al, A practical outcome scale for paediatric head injury, Archives of Disease in Childhood, 2001: 84: 120-124.

- Six months or more after the accident, the insured person’s level of neurological function does not exceed category 3 (Severe disability) on the King’s Outcome Scale for Childhood Head Injury as published in Crouchman, M. et al, A practical outcome scale for paediatric head injury, Archives of Disease in Childhood, 2001: 84: 120-124.

- Nine months or more after the accident, the insured person’s level of function remains seriously impaired such that the insured person is not age-appropriately independent and requires in-person supervision or assistance for physical, cognitive or behavioural impairments for the majority of the insured person’s waking day.

55% Whole Person Impairment: Singular or Combination of Physical Impairment(s)

- Subject to subsections (2) and (5), a physical impairment or combination of physical impairments that, in accordance with the American Medical Association’s Guides to the Evaluation of Permanent Impairment, 4th edition, 1993, results in 55 per cent or more physical impairment of the whole person.

55% Whole Person Impairment: Combination of Mental or Behavioural Impairment and Physical Impairment

-

- Subject to subsections (2) and (5) a mental or behavioural impairment, excluding traumatic brain injury, determined in accordance with the rating methodology in Chapter 14, Section 14.6 of the American Medical Association’s Guides to the Evaluation of Permanent Impairment, 6th edition, 2008, that, when the impairment score is combined with a physical impairment described in paragraph 6 in accordance with the combining requirements set out in the Combined Values Table of the American Medical Association’s Guides to the Evaluation of Permanent Impairment, 4th edition, 1993, results in 55 percent or more impairment of the whole person.

Mental or Behavioral Disorder: Class 4 Marked Impairment or Class 5 Extreme Impairment

- Subject to subsections (3) and (5), an impairment that, in accordance with the American Medical Association’s Guides to the Evaluation of Permanent Impairment, 4th edition, 1993 results in a class 4 impairment (marked impairment) in three or more areas of function that precludes useful functioning or a class 5 impairment (extreme impairment) in one or more areas of function that precludes useful functioning, due to mental or behavioural disorder. O. Reg. 251/15, s. 3; O. Reg. 116/16, s. 1.

Additional Preconditions

Furthermore, section 3.1(2) of the SABS 34/10 notes that the aforementioned paragraphs 6 and 7 of subsection (1) do not apply in respect of an insured person who sustains an impairment as a result of an accident unless the following:

- two years have elapsed since the accident; or

- an assessment conducted by a physician three months or more after the accident determines that,

- the insured person has a physical impairment or combination of physical impairments determined in accordance with paragraph 6 of subsection (1), or a combination of a mental or behavioural impairment and a physical impairment determined in accordance with paragraph 7 of subsection (1) that results in 55 per cent or more impairment of the whole person, and

- the insured person’s condition is unlikely to improve to less than 55 per cent impairment of the whole person. O. Reg. 251/15, s. 3.

Section 3.1(3) of the SABS 34/10 notes that the aforementioned paragraph 8 of subsection (1) does not apply in respect of an insured person who sustains an impairment as a result of the accident unless the following:

- two years have elapsed since the accident; or

- a physician states in writing that the insured person’s impairment is unlikely to improve to less than a class 4 impairment (marked impairment) in three or more areas of function that precludes useful functioning, due to mental or behavioural disorder. O. Reg. 251/15, s. 3.

Section 3.1(4) of the SABS 34/10 notes that subsection (5) applies to an insured person who was under the age of 18 at the time of the accident and whose impairment is not a catastrophic impairment within the meaning of subsection (1). O. Reg. 251/15, s. 3.

Analogous Impairment

Lastly, section 3.1(5) of the SABS 34/10 notes that if the insured person’s impairment can reasonably be believed to be a catastrophic impairment for the purposes of paragraph 6, 7 or 8 of subsection (1), the impairment shall be deemed to be the impairment referred to in paragraph 6, 7 or 8 of subsection (1) that is most analogous to the impairment, after taking into consideration the developmental implications of the impairment. O. Reg. 251/15, s. 3.

Catastrophic Injury/Impairment Classification

If you or your healthcare provider thinks that your accident-related injuries satisfy the legislative criteria of a catastrophic impairment, which is set out in the aforementioned section 3.1(1) of the SABS 34/10, then you’ll have to get your healthcare provider or treating specialist to submit an Application for Determination of Catastrophic Impairment (OCF-19) form to your insurer. It’s of the utmost importance that you select the right healthcare provider or treating specialist, in that the nature of your accident-related injuries falls within the scope of practice of the healthcare provider or treating specialist. So, for example, accident-related traumatic brain injuries fall within the scope of practice of a neurologist, who “deals with the diagnosis and treatment of all categories of conditions and disease involving the central and peripheral nervous systems (and their subdivisions, the autonomic and somatic nervous systems), including their coverings, blood vessels, and all effector tissue, such as muscle” — Wikipedia definition.

You can access, fill in online, and download in PDF format, the OCF-19 form from the Financial Services Regulatory Authority of Ontario’s website at the following URL link:

http://www.fsco.gov.on.ca/en/auto/forms/Documents/SABS-Claims-Forms/1331E.pdf

If on the basis of this Application, your insurer concludes that your injuries are deemed to satisfy the criteria for a catastrophic impairment, then your insurer will designate you as catastrophically impaired. Then you’ll transition to the catastrophic injury/impairment classification, where your applicable accident benefit policy limits would increase to at least $1 million, unless you have purchased any optional increased benefits under your automobile insurance policy. Furthermore, the catastrophic impairment designation will grant you access to the highest tier of accident benefits, thereby entitling you to request extended medical rehabilitation and attendant care benefits, and other expenses. Your insurer may request a section 44 insurer’s medical examination, where they’ll retain a physician to assess you for the purpose of determining whether or not you should be designated as catastrophically impaired. If their physician determines that you’re not catastrophically impaired, then as your lawyer I will retain a physician to assess you and complete a rebuttal medico-legal report, and proceed to appeal the insurer’s determination to the Licence Appeal Tribunal and fight for you to get the catastrophic impairment designation.

Catastrophic Impairment Definition Prior to the June 1, 2016 Amendments

Prior to September 1, 2010, only two categories of impairment existed: non-catastrophic and catastrophic impairment.

Prior to June 1, 2016, catastrophic impairment was defined as follows under subs. 3(2):

- (2) For the purposes of this Regulation, a catastrophic impairment caused by an accident is,

-

- paraplegia or quadriplegia;

- the amputation of an arm or leg or another impairment causing the total and permanent loss of use of an arm or a leg;

- the total loss of vision in both eyes;

- subject to subsection (4), brain impairment that results in,

-

-

- a score of 9 or less on the Glasgow Coma Scale, as published in Jennett, B. and Teasdale, G., Management of Head Injuries, Contemporary Neurology Series, Volume 20, F.A. Davis Company, Philadelphia, 1981, according to a test administered within a reasonable period of time after the accident by a person trained for that purpose, or

- a score of 2 (vegetative) or 3 (severe disability) on the Glasgow Outcome Scale, as published in Jennett, B. and Bond, M., Assessment of Outcome After Severe Brain Damage, Lancet i:480, 1975, according to a test administered more than six months after the accident by a person trained for that purpose;

-

- subject to subsections (4), (5) and (6), an impairment or combination of impairments that, in accordance with the American Medical Association’s Guides to the Evaluation of Permanent Impairment, 4th edition, 1993, results in 55 per cent or more impairment of the whole person; or

- (f) subject to subsections (4), (5) and (6), an impairment that, in accordance with the American Medical Association’s Guides to the Evaluation of Permanent Impairment, 4th edition, 1993, results in a class 4 impairment (marked impairment) or class 5 impairment (extreme impairment) due to mental or behavioural disorder. O. Reg. 34/10, s. 3 (2).

Subsection 3(3) noted that subsection (4) – below – applies if an insured person is under the age of 16 years at the time of the accident and none of the Glasgow Coma Scale, the Glasgow

Outcome Scale or the American Medical Association’s Guides to the Evaluation of Permanent Impairment, 4th edition, 1993, referred to in clause (2) (d), (e) or (f) – above – can be applied by reason of the age of the insured person. O. Reg. 34/10, s. 3 (3).

Subsection 3(4) noted that for the purposes of clauses (2) (d), (e) and (f), an impairment sustained in an accident by an insured person described in subsection (3) that can reasonably be believed to be a catastrophic impairment shall be deemed to be the impairment that is most analogous to the impairment referred to in clause (2) (d), (e) or (f), after taking into consideration the developmental implications of the impairment. O. Reg. 34/10, s. 3 (4).

Subsection 3(5) noted that clauses (2) (e) and (f) do not apply in respect of an insured person who sustains an impairment as a result of an accident unless the following:

- a physician or, in the case of an impairment that is only a brain impairment, either a physician or a neuropsychologist states in writing that the insured person’s condition is unlikely to cease to be a catastrophic impairment; or

- (b) two years have elapsed since the accident. O. Reg. 289/10, s. 1 (2).

Lastly, subsection 3(6) noted that for the purpose of clauses (2) (e) and (f), an impairment that is sustained by an insured person but is not listed in the American Medical Association’s Guides to the Evaluation of Permanent Impairment, 4th edition, 1993 is deemed to be the impairment that is listed in that document and that is most analogous to the impairment sustained by the insured person. O. Reg. 34/10, s. 3 (6).

Therefore, essentially, the 1996 definition included: paraplegia/quadriplegia, amputation, loss of use of limbs, blindness, significant brain injury, significant physical impairments of the whole person, marked mental and behavioural impairments or a combination of physical and psychological impairments of 55% or more whole person impairment.

Effective September 1, 2010, a new category of impairment was added called the Minor Injury Guideline, in addition to the non-catastrophic and catastrophic categories.

This three-tier system of impairments continues to apply today.

Again, if you want to learn more about the companion accident benefits claim, and kickstarting the accident benefits application process, then please click the “link” to read my blog entitled “How to Get Your Accident Benefits Application Started”.

I hope you found this information valuable. Rudder Law Group’s website is your one-stop source for answers to all of your legal questions concerning catastrophic impairment law and personal injury law.